There is no denying the importance of filtration in the modern age. Medical filters can safeguard sterile environments, like operating rooms, by keeping out harmful pathogens and bacteria. Filters in vehicles make them more efficient. And with government regulations and environmental concerns, the filtration market is undeniably on a path toward continued growth.

The following is part three in a three-part series in International Filtration News considering key market trends within the filtration market. Part one considered the overall filtration market, drivers and size (IFN Issue 4 2021, pages 46-47). Part two offered a deeper look at the market for air filtration applications and technology (IFN Issue 5 2021, pages 46-47). And this third and final part of the series examines liquid filtration.

Liquid filtration

Liquid filtration is more than just water; liquid filters are also employed over a wide variety of fluids and applications. Liquid filtration applications tend to be concerned with the filtration of either aqueous or hydrocarbon fluids. As with the air filtration industry, the liquid filtration market captures a wide variety of end uses.

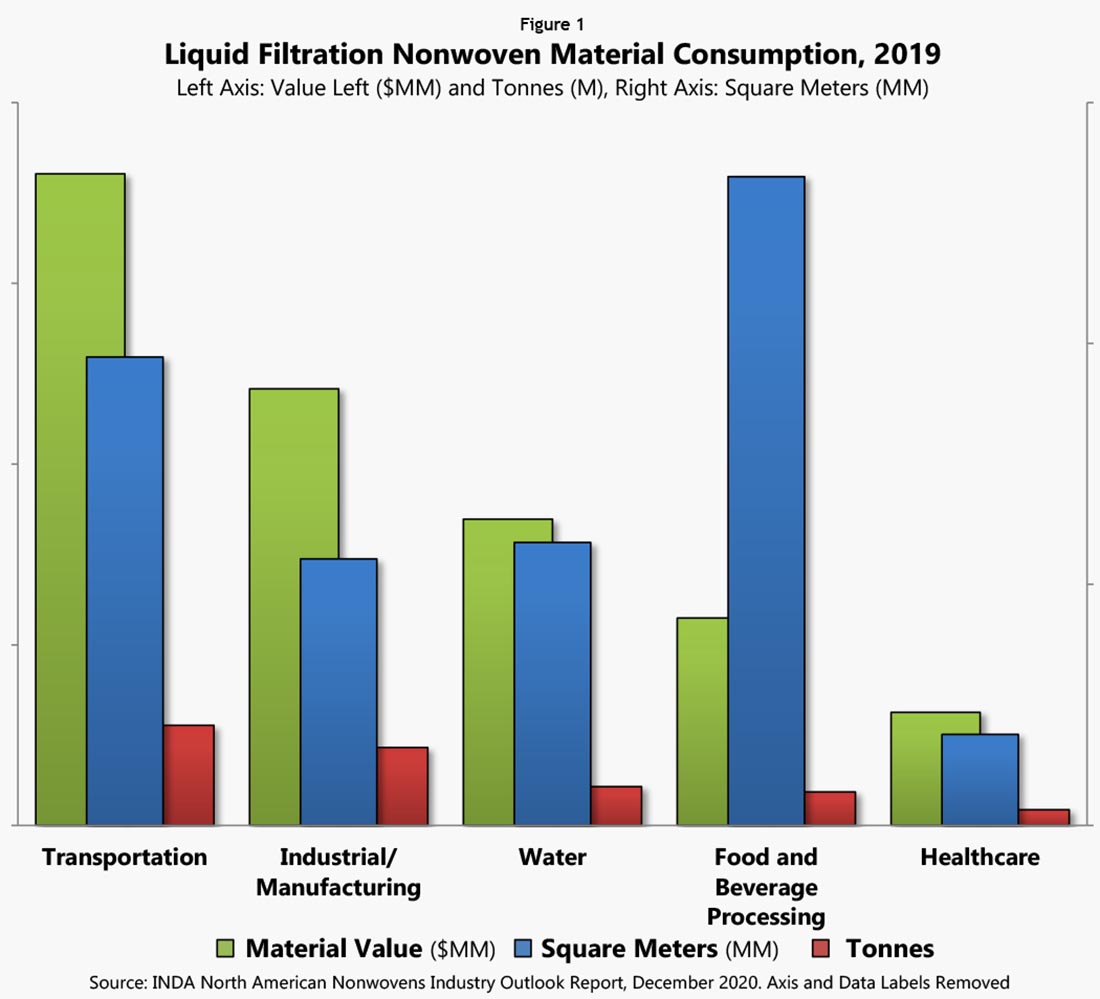

INDA has segmented the liquid filtration category into filters used, in tonnage order, for:

- Transportation, primarily oil, lubrication, fuel, and transmission filters

- Industrial/Manufacturing, segmented into high technology, hydraulics, hydrocarbon processing, and industrial processes

- Water, segmented into industrial processes, swimming pool/spa and water treatment

- Food and Beverage Processing, primarily bottled beverages, coffee filters, cooking oil, milk, tea bags and other aqueous foods and beverages

- Healthcare, segmented into biotechnology/pharmaceutical and blood

Liquid filtration based on nonwoven media is generally not considered an absolute method of purification because particles of 1 μm or less in size can pass through the media. In many applications where sub-micron contaminants are present, further separation is required.

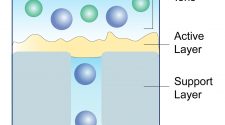

Membrane- and nanofiber-based filtration and separation processes employ a membrane or nanofibers layered onto a nonwoven support, which increases the strength and improves the particle-retention capacity. Some of these membranes are so thin and fragile that they can only be produced by directly being coated onto the nonwoven carrier’s surface.

Unlike air filtration, the mechanisms of liquid filtration and separation are equally used and none of the applications dominate the field of solid/liquid separation. Replaceable filter elements are used in many filter applications. Two of the most common types using nonwovens are liquid bag filters (similar to air filtration baghouse filers) and cartridge filters, in addition to nonwovens being used as a membrane medium. One of the biggest uses of nonwoven filter media in liquid filtration is in cartridge filters, both in transportation, industrial applications and consumer water applications (water filters and swimming pool/spa filters). Cartridge filters make use of membrane, nonwoven, string wound, metal and carbon filters.

The most common fibers used in liquid filtration are polypropylene (PP), polyethylene (PE), polyester (PET), polybutylene terephthalate (PBT), nylon, glass, and cellulose.

The largest category depends upon the unit of measurement. The liquid food and beverage processing filtration end uses consumed a third (37%) in area of the nonwoven material, while transportation accounted for the greatest in tonnage, accounting for just over a third (38%) of the tonnes in 2019, and in terms of nonwoven media value transportation is the largest accounting for 38% (Figure 1).

Below is the North American growth outlook (2020–2024) for each of the categories, in a simplified format, followed by a brief summary for each.

++++ Healthcare

+++ Transportation

++ Food and Beverage Processing

++ Industrial/Manufacturing

+ Water

Demand for liquid filters is as varied as the end uses, though some of the more common drivers are:

- Transportation filtration is driven by the absolute increase in the number of vehicles driven and produced in North America, though slowed by longer service intervals.

- Industrial and manufacturing usage is driven by an increase in membrane usage, wastewater regulations, and the need to streamline the manufacturing processes to boost efficiency and improve carbon footprint. Metal catalysts are commonly used in chemical processes to speed the rate of reaction. The catalysts are consumed in the process, and it is desirable to recover them for reuse—in particular, as gold, platinum and palladium can be costly. In many of the manufacturing processes, filtration is critical for the protection of downstream equipment to keep the machines running and free of costly repairs.

- Hydraulic filters in heavy machinery and equipment is driven by tighter tolerances required for finer filtration.

- Hydrocarbon processing is driven primarily by the oil and gas industry through hydraulic fracturing, offshore drilling, and the enhanced recovery of resources.

- High technology is driven by semiconductor products and the need for ultrapure fluids. Semiconductor plants use CMP (chemical mechanic polish) for the manufacture of silicon wafers. The particles in the slurry perform an important function of acting as an abrasive, but if oversized particles are present, they can scratch and gouge, rather than polish.

- Water filtration is driven by the demand for clean water and an aging infrastructure.

- Food and beverage processing is driven by health, safety and government regulations, in addition to increased demand with an absolute increase in population.

- Healthcare is driven by health and safety concerns. Pharmaceutical and biotech manufacturing demand ingredients that are free of not only particles, but also minute microorganisms

The liquid filtration market, like the air filtration market, is indeed a diverse one with seemingly endless categories. The various drivers and developments have resulted in the North American liquid filtration market consuming an ever-greater amount of nonwoven material having expanded 4.1% annually in weight and 4.0% in volume through the historical period (2014–2019). This growth will continue through the forecast period (2020–2024), as reported in INDA’s North American Nonwovens Industry Outlook, 2019-2024, report.

The North American Nonwovens Supply report is one of three INDA member-publications produced by INDA’s Market Intelligence and Economic Insights Group. For additional information on these publications and other INDA member benefits, please visit www.inda.org/indamembers/index.html.

International Filtration News is owned by INDA, Association of the Nonwoven Fabrics Industry (inda.org).