This is Part I in a two-part series highlighting mega trends that are paving the way for significant growth in filtration applications and technology now and in the years to come. Part II in this series, “In the trends of today, we see the future of filtration,” appeared in Issue 5 2021 (pages 24-30) of IFN and can be found at https://www.filtnews.com/in-the-trends-of-today-we-see-the-future-of-filtration/.

There have been many articles and exciting talks about the positive impact global mega trends are having on filtration markets. Ever-increasing urbanized populations with access to middle class incomes are driving demand for filter media to historic levels.

In certain parts of the world, there is rapid adoption of external cabin air units in personal automobiles and hand-held PM 2.5 air quality meters are suddenly everywhere, to name just a couple of examples.

Because of these trends, new growth accelerators are emerging and consumer awareness, government regulations and voluntary corporate environmental policies are accelerating the use of advanced filtration systems.

Even prior to the COVID-19 pandemic, consumer awareness had been driving innovation in the filtration industry. Shifting norms and a strong understanding of filtration benefits are creating new growth opportunities. An increasing appreciation for clean air and evidence demonstrating the health benefits of improved indoor air quality are driving the expansion of the air filtration market. Meanwhile, issues with water quality and water shortages are increasing the need for wastewater filtration and recycling. Government regulations are targeting emissions and setting minimum requirements for commercial indoor air quality in an effort to meet society’s needs.

Responding to these trends, many companies are voluntarily adopting environment, social and governance policies – commonly referred to as ESG Criteria – to prepare for the future. COVID-19 has accelerated and broadened the scope of these widely recognized trends; facemasks, airplanes, office buildings and process liquids for vaccines are just the beginning of a new larger filtration growth cycle.

Prior to COVID, filtration was an industry with a bright future, but 2020 will certainly be seen as a watershed moment for those involved with filtration.

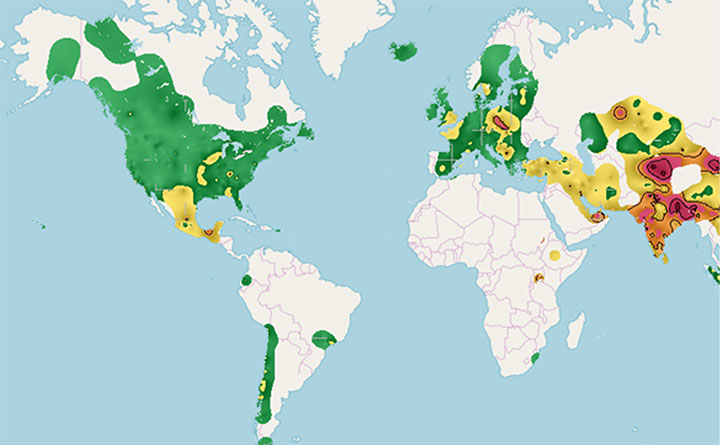

Air quality is a global issue

Most of the world lives in densely populated urban areas with unhealthy air quality. Automotive exhaust, construction dust and coal-fired emissions all but ensure developing countries have PM2.5 measurements well above levels the World Health Organization (WHO) would consider healthy.

The demand for clean air was once a fight led by environmentally minded groups or citizens exposed to local polluters. People with a deep understanding of the negative health impact were motivated to protect themselves. We now have a unique situation where anyone with a smart phone or internet connectivity can have access to their outdoor air quality measurement in real time.

Increasingly, less expensive hand-held devices can constantly monitor the air quality inside one’s home. Hotels have found a value proposition around air quality, offering rooms that have guaranteed clean air for a charge. The availability of accurate measurement systems, access to data and a deepening understanding of the effects of air quality are increasing the value for filtration. Consumers are choosing to protect themselves and their families from poor air quality, not just in regions with pollution concerns, but in areas known to have consistently good air quality.

Globally about 7 million people a year die early – by at least eight months – because of air pollution.[1] Even in the United States, which traditionally has some of the cleanest air in the world, 100,000 premature deaths annually are attributed to poor air quality. The costs associated with bad air are astronomical, with $1.7 trillion dollars spent globally on healthcare costs related specifically to air pollution.[2]

Air quality resonates with consumers

The economic and personal impacts of bad air resonate with consumers. Just 15 years ago in the United States, only about 40% of new vehicles came with a cabin air filter. Less than 10% of those cars had an air filter containing carbon.

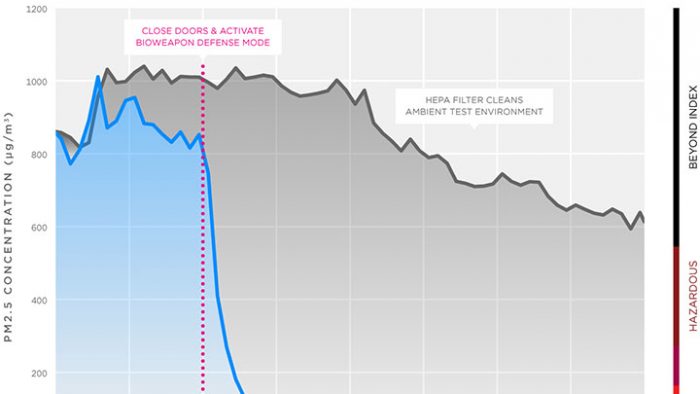

In 2021 virtually all new vehicles – over 15 million annually in the U.S. – come with a cabin air filter and almost half come with a high-end filter containing carbon. In the fast-growing EV market we see models with true HEPA-grade filtration. In 2020 Elon Musk, carrying a Tesla HEPA grade cabin air unit on stage, called the filter a “Bioweapon Defense” that offered 10 times more protection than standard automotive filters.

Twenty years ago, whole home air filtration units started with a MERV 7 filter that was meant to protect the fan unit more than the people living in the home. The basis of air filtration started with equipment protection. However, as consumer’s understanding grew, so did their demand for performance. A better HVAC air filter that removed bacteria, mold and smoke moved protection beyond the air handling system to the homeowner. Even prior to COVID-19, the industry was seeing the growing demand for MERV 13 filtration technology.

Advanced filtration for liquids

Water quality has also become a global issue recognized by the average citizen. Humans need 20-50 liters of safe, clean water a day. The decline in water quality has become a concern as human populations grow. As industrial and agricultural activities expand, changes in climate threaten to cause major alterations to the hydrological cycle. The most prevalent water issues are contamination and scarcity. In 2010, in recognition of this issue, the United Nations declared access to clean water a basic human right.[3]

What was once thought to be a problem only in developing countries has become a first world problem. The world’s fastest growing cities are in places where water is in short supply. Consumers with disposable income are prioritizing their long-term health as a result. Municipal water cleanliness incidents, such as the Flint, Michigan crisis in 2014, are embedded in people’s mind. They are reinforced by public advocacy groups; the National Resource Defense Council called the Flint water crisis an environmental injustice created by bad public decision-making. This has led consumers to demand access to clean water, and these demands are in turn creating large growth opportunities in advanced filtration.

Municipal water treatment facilities have finite space to operate and limited access to fresh water. As cities grow, so do the demands on water supply. Rather than just provide basic wastewater treatment, municipalities are upgrading their capabilities. Direct-to-potable (DPR) systems have long been popular overseas, but they are now also becoming popular in the United States. Over 16,000 treatment plants in the U.S. are using DRP. The city of Las Gallinas, California, used such a system to increase its ability to filter recycled water by as much as 10 times over the previous water treatment facility. Located in an area severely susceptible to draught, the ability to re-use water was critical. The improved filtration performance comes through increased use of cartridges that must be able to deliver 0.50-micron efficiency.

Old filter media technologies, used for decades, can no longer deliver the necessary performance. Advanced filtration technology is essential in delivering consumers the final product they demand. A $2.2 billion market, up 37% over traditional municipal water spending, provides a secure, attractive market segment for future growth.

The global home water filtration unit market – also known as Point of Use (POU) or Point of Entry (POE), depending on how it is sold – was $8.6B in 2018 with a 15.9% CAGR expected to continue through 2025.[4]

Product penetration in the U.S. is relatively higher than the developing world, as 40 million Americans get their home drinking water from wells. Growing consumer awareness about the effects of contaminated water have shifted the thinking about home-based domestic water purification. Preferences have shifted substantially to long-term solutions, such as water purifiers.

The market is also shifting as these technologies take hold in multi-family and hospital environments. The value of ownership is an old concept where there is a tendency to acquire assets which could give results for a long duration. This idea of filtration being a significant factor in total cost of ownership is well established and growing. Our industry is strategically placed in a positive disruptive space. It’s clear that basic filtration markets can demand the value they bring to both human and machine protection. This increased awareness is not just growing traditional air and water applications, but it’s creating whole new markets.

We clearly see that consumers understand the value of water and will pay for the benefits provided by filtration.

This is Part I in a two-part series highlighting mega trends that are paving the way for significant growth in filtration applications and technology now and in the years to come. Part II in this series will address filtration mega trends in automotive, facilities, regulatory, emissions and COVID-19 impacts, among others.

References

- “Air Pollution,” World Health Organization, https://www.who.int/health-topics/air-pollution#tab=tab_1

- Organization for Economic Cooperation and Development.(OCED), “The economic consequences of outdoor air pollution,” https://www.oecd.org/environment/indicators-modelling-outlooks/Policy-Highlights-Economic-consequences-of-outdoor-air-pollution-web.pdf

- “International Decade for Action ‘Water for Life’ 2005-2015,” United Nations Department of Economic and Social Affairs (UNDESA),” https://www.un.org/waterforlifedecade/human_right_to_water.shtml

- “Home Water Filtration Unite Market Size, Share & Trends Analysis,” Grand View Research, https://www.grandviewresearch.com/industry-analysis/home-water-filtration-unit-market