This is Part II in a two-part series highlighting mega trends that are paving the way for significant growth in filtration applications and technology now and in the years to come. Part I in this series, “Elements align for a filtration boom,” appeared in Issue 4 of IFN (pages 21-23) and can be found at filtnews.com/elements-align-for-a-filtration-boom/.

According to Ford Motor Company, the number of cars and multi-purpose vehicles equipped with automatic transmissions that it sells in Europe has more than tripled over the past three years. Automatic transmissions accounted for 10% of Ford’s European sales in 2017. That figure tripled to 31% in early 2020 and is expected to continue rising steadily.

The United Kingdom has seen the same trend, with nearly 40% of all vehicle sales having automatic transmissions in 2017, up from just 25% five years earlier. The U.S. is firmly in the automatic camp, with only 2% of all vehicles sold having manual transmission.

While drivers have traditionally preferred to shift their own gears, consumers are increasingly demanding on-road comfort, access to safety features, such as adaptive cruise control with stop-and-go functionality, and advanced parking assistance – none of these features work with traditional manual transmissions. There is also the ever-increasing desire for improved fuel economy. All of these factors are good for the environment, road safety, and good for the filtration industry, as advanced automatic transmissions need good filters.

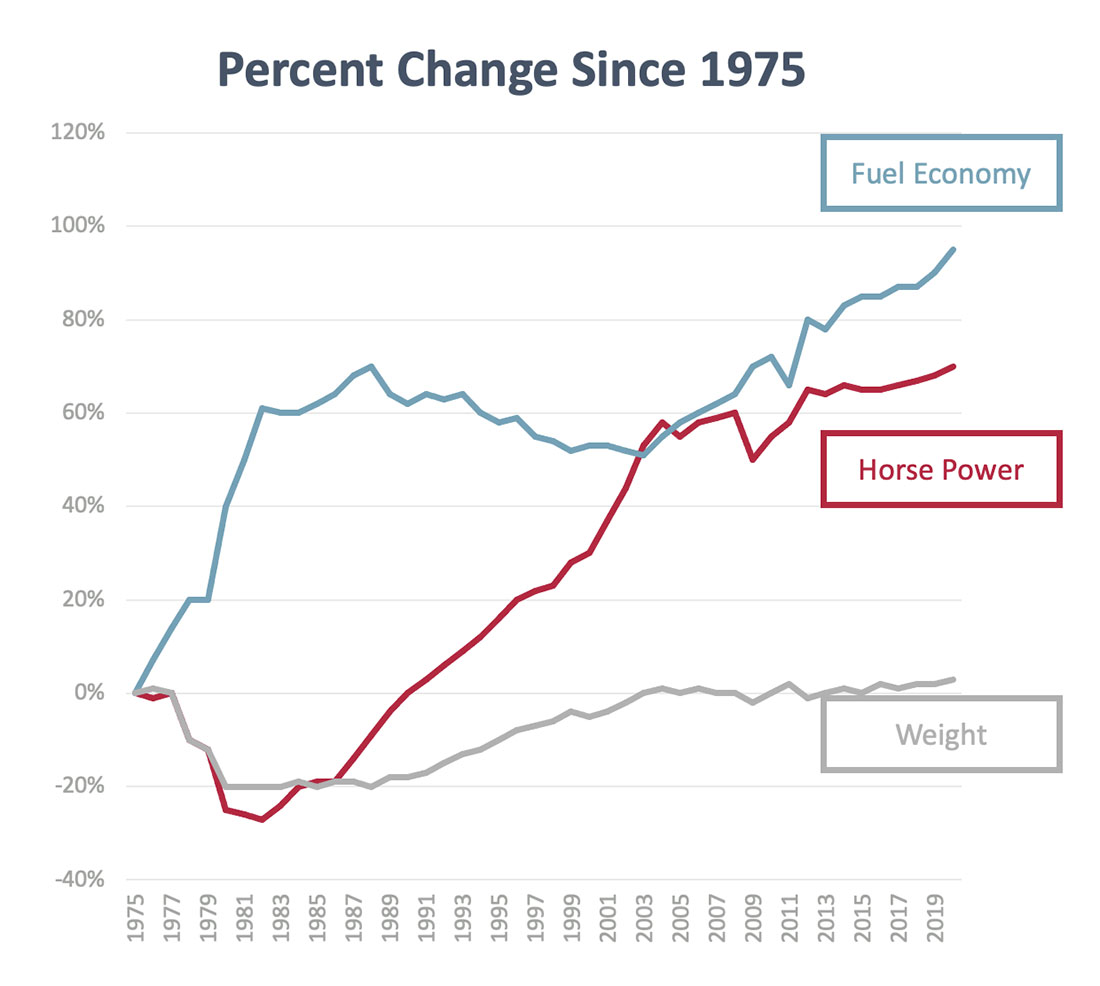

And it’s not just about comfort, the International Energy Agency says that CO2 from fuel combustion accounts for 92% of energy pollution. In recognition of this problem, fuel consumption in combustion engines has been reduced by 1.5% per year over the past 40 years. This is all while total global consumption for transportation fuel increased by 25%. The Internal Combustion Engine has steadily been improved. To make further improvements in fuel economy and give consumers the performance they demand, automakers have started to optimize automatic transmissions.

Traditionally manual transmissions were preferred for low gas consumption. Through innovation, automatic transmissions have increased the traditional number of gears from the 4-6 range up to 10 and are now achieving higher miles per gallon of fuel compared to traditional manual transmission cars. The use of Standard Continuous Variable Transmissions and Dual Clutch Transmissions typically require 5-7 liters of hydraulic oil. Newer automatic transmissions models require only half the amount of oil. This in turn places significant demand on the transmission filters.

Highly efficient filtration with less surface space is required in these new applications. Where once a cellulose-type filter media was adequate, a multi-gradient composite filtration media is now required. The growth in this market is not dependent on the Internal Combustion Engine either, as the same trend is seen in hybrid and fully electric cars. To improve both comfort and fuel consumption, while achieving high performance contamination removal, all automobile types will be rapidly moving to high-speed automatic transmissions.

This is one prominent example where consumer demands drove innovation that led to demanding filtration applications in a high growth market.

Regulatory watch

Regulations have long been a driver for growth in filtration. Fuel economy standards in the U.S., Europe, India and China dictate the performance required for diesel fuel filtration in our industry. These well-known standards drive innovation and growth. Indoor Air Quality is commonly measured by the Minimum Efficiency Reporting Value – or MERV – giving a clear and concise rating system to air cleanliness consumers can expect in their homes and the businesses they frequent. These are only two examples of the most common standards the filtration industry follows. Top-down driven regulations have long been a part of our lives in the filtration business. These rules are ever changing, increasing the demands put on filtration performance.

With more frequency we are seeing the market demand performance beyond the scope of national standards and quasi-government boards. We hear more and more about the convergence of government directives combined with voluntary standards companies adopt. These voluntary rules help measure how those companies perform as stewards of the environment. They are also supported by total cost of performance provided in reduced spending required in healthcare and other critical savings – giving companies a financial motivation to adopt standards.

Environmental, Social & Governance (ESG) criteria, investors and consumers can gauge a company’s attitude and performance around energy use, waste, pollution and natural resource conservation. In this way, consumer understanding has moved the filtration industry beyond the control of local governments.

Public understanding of the value we bring as an industry seems likely to continue the rapid adoption of voluntary standards such as LEED and the WELL building standards previously discussed. What were already strong growth patterns in filtration are being accelerated by the global pandemic.

Recognition or appreciation of the existence of sick building syndrome is becoming more commonplace. “Well Certified” buildings, LEED standards and other voluntary, market-driven building ratings are creating significant growth opportunities for the filtration industry. These challenges and opportunities will take creativity and innovation to meet. The reward will be long-term growth.

Emission regulations drive growth

Since the early 1990s, new vehicle models have had to meet increasingly stringent exhaust pollution limits. These standards have different names around the world, but all have the same goal of improving air quality and health while also improving fuel efficiency. The first European exhaust emission standard for passenger cars was introduced in 1970.

It was 22 years before the next big change when, in 1992, the Euro I standard brought about the modern era of CO2 emission reduction. The last several standard updates, from Euro III to Euro VI, have been focusing on PM2.5 and NOx, the most problematic air pollution for human health.

Exhaust gas emission from vehicles, especially heavy-duty trucks, was by far the top contributor to PM2.5 and NOx pollution. The Euro VI standard applies to all new vehicles since September 2015 and reduces PM2.5 by 96% and NOx by 84% compared to Euro III. Just a year later in 2016 Euro VI was made even more stringent with the addition of an extended on-road emission test known as Real Driving Emissions (RDE). With these efforts, the current cleanliness level of exhaust gas surpasses most ambient air quality.

How does filtration support this? A low emission diesel engine cannot exist without high-performance filtration.

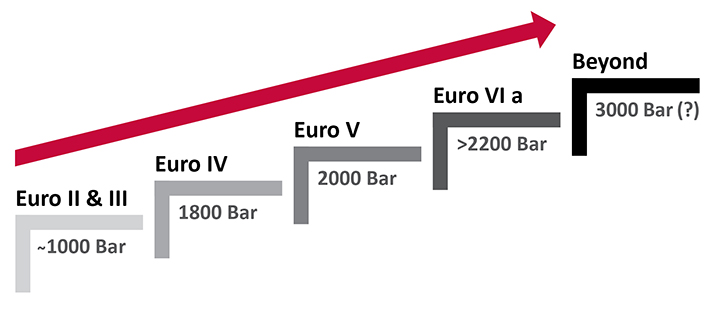

The initial slow adoption of these regulations allowed considerable time for technology to develop and adapt to change. However, the demand for lower emissions led to the development of the Common Rail System, which in turn created tighter tolerances and significantly higher pressure within the fuel system. Enabling this improved technology is the diesel fuel filtration system, which withstands the harsh environments all while performing the duty of keeping injectors clean and working properly. At the cutting edge we have ultra-high pressure – 3,000 bar – common rail fuel systems that enable medium and heavy-duty vehicles to meet the requirements of Euro VI, US13 and future emissions legislations.

The requirement for water removal has been significantly increased as well. Filtering 10um water droplets at low interfacial tension (IFT, from 21 to 12) for the whole life of the filter while increasing service intervals of heavy-duty trucks to as much as 100,000 miles has created significant challenges.

Traditional medias are no longer of use in these harsh environments. In order to ensure the protection needed for the much finer and more expensive systems, cellulose medias have given way to blended materials, glass containing medias and sophisticated composite materials. The market for filtration grows as the performance improves. Fuel filters are no longer a run of the mill filter, instead they allow highly advanced technologies to deliver precise and repeatable control of injection events combined with ultra-high pressures.

With all the complexity of change and longer service intervals, the number of filters used is going down, yet the importance of the filters is getting considerably higher, and so is the value of the filters. As an effect, the fuel filtration market will continue to grow faster than GDP, as the market becomes increasingly technical, and performance driven. The upgrade is not only for developing marketing such as China, India and Brazil, but also for mature markets in the U.S. and Europe.

Even with the strong push for electrification, heavy-duty trucks and off-road machinery will continue to rely on diesel fuel power for the next 10-15 years until EV or fuel cell technology is mature enough to offer an alternative in this area.

Aspirational legislation

In fuel filtration we see an example of government rules and regulations creating growth opportunities in filtration. ASHRAE is a technical society without a legal mandate, but for decades state and local governments model their codes based on ASHRAE standards. Our industry is growing rapidly as the world is pushing beyond these guidelines. The U.S. Green Building Council’s LEED program continues to set new standards for air filtration. This desire for clean air, increased energy efficiency and sustainable spaces are becoming more broadly accepted.

As a result, we are starting to see even more aspirational standards being established. Launched in 2014, the WELL Building Standard looks to address the health issues of the modern office. These health-related issues are sometimes called “Sick Building Syndrome” – where lack of mobility, poor air quality and workplace stress affect the daily health of occupants. The WELL Building Standard is the first of its kind to focus on health and wellness by addressing air, water and several other factors of quality throughout buildings.

The WELL Building Standard’s intent is to promote clean air through reducing or minimizing the sources of indoor air pollution, requiring optimal indoor air quality to support the health and wellbeing of occupants. HEPA filters are required to ensure indoor air meets incredibly stringent particulate requirements. By keeping air handling units clean and running efficiently, all while lowering energy consumption, WELL standard buildings can meet the stated goal of improving lives.

Prior to COVID, there was already a strong trend toward high-end filtration. As of 2018, there were 780 completed WELL projects – 147 million square feet of real-estate in 32 countries. Today, just three years later, almost eight times – 6,000 projects – have been completed with over 850 million square feet across 67 countries. The value of the global HVAC filtration market has been on a significant growth trajectory with no real end in sight.

And then came COVID-19

Prior to COVID-19, the filtration industry was in a pretty good place – demanding applications with ever-increasing performance requirements across a broad spectrum of interesting markets. Then came the pandemic …

Before COVID everyone was familiar with what a facemask was used for and why, but only industry insiders really discussed the details of N95 and the difference between it and KN95, surgical masks, etc. Now the majority of people have a solid understanding of facemask technology.

Airlines are now advertising HEPA-grade handling systems complete with air circulation and particulate level statistics on flights. The average traveler is starting to speak the language of filtration.

Doctors and dentist offices field calls from patients asking if they provide MERV 13-level air filtration. School boards have settled on the need for HEPA filtration for the re-opening of schools, or at least a plan to get there in the near future. And the U.S. government recently allocated hundreds of millions of dollars to support filtration upgrades in schools. Restaurants, public buildings, malls – all of these public areas need “clean indoor air,” and being able to provide clean air could mean the ability to stay open in the future.

While most people have developed a good understanding of why greater than six feet of distance and masking are essential to slowing the spread of airborne diseases, getting people to wear appropriate masks in the right way has been a major challenge for a variety of reasons.

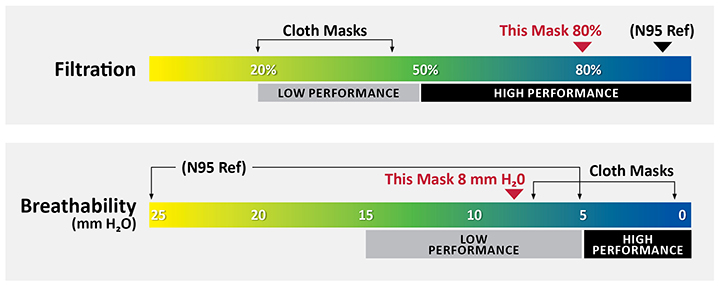

At times, a lack of rated masks has forced people to make use of substandard homemade masks. Also, millions of users have learned firsthand about breathability in relation to the amount of protection they are receiving. Without access to rated masks and common standards, many people will choose an inappropriate mask.

Rated respiratory devices and facemasks, both community and surgical masks, are facing strict standards. For companies producing masks, not meeting these standards can result in products being recalled. There are many examples of inferior product in the market not meeting the standard requirements.

New habits dictate future demand

When the pandemic hit, filter capacity constraints developed quickly. To provide support, the nonwovens industry came together to maximize production, prioritize medical needs and help set a minimum meaningful common standard in the market. The industry created a clear, consistent set of expectations to provide source control and ensure consumers have a facemask option going forward that provides a minimum level of protection from particulate matter.

The development of ASTM F3503 was the result of these efforts. This standard for facemask filtration performance allows for non-traditional media to be used. These materials outperform a regular cloth mask or gaiter, providing an increased amount of security to users, while at the same time leaving higher-performing materials, such as meltblown and the electrets commonly employed for N95 and similar masks, to be used in applications where higher performance is needed.

With the rapid expansion of the market for filter media created by the pandemic, the big question is what the RPE (respiratory protective equipment) market will look like after the pandemic. Three factors figure to drive future demand:

- The shift from less effective masks to more effective masks – meaning a wider use of N95 in medical and dental fields, and sometimes the use of multiple masks at once, especially in healthcare.

- Broad acceptance and usage as consumers continue to consume facemasks after the pandemic.

- Government and corporate programs for stockpiling masks will continue to be a reality into the foreseeable future.

Filtration everywhere

The rapid and long-term increase in demand for facemasks is the most visible impact of the pandemic on filtration, but as early as April 2020 health experts were associating “healthy” buildings with protection from COVID.

With the typical MERV 8 filter only capturing around 50% of small particles, consumer demand is expected to continue pushing for the adoption of MERV 13 filters in public buildings and homes. Customers increasingly understand the relationship between MERV 13 and 80-90% particle capture. And while the industry has long been operating with an understanding of HEPA capturing 99.97% of particles – now homeowners and consumers understand this concept as well.

As HEPA levels of filtration increasingly become associated with long-term health, growth will continue for filtration in public buildings, private homes, vehicle cabins and beyond. It’s worth noting that pre-COVID consumer understanding of HEPA was typically limited to vacuum cleaners for reducing allergens/nuisance dust in the home.

Public understanding of the value we bring as an industry seems likely to continue the rapid adoption of voluntary standards such as LEED and the WELL building standards previously discussed. What were already strong growth patterns in filtration are being accelerated by the global pandemic.

Better liquid filtration will help fight future pandemics

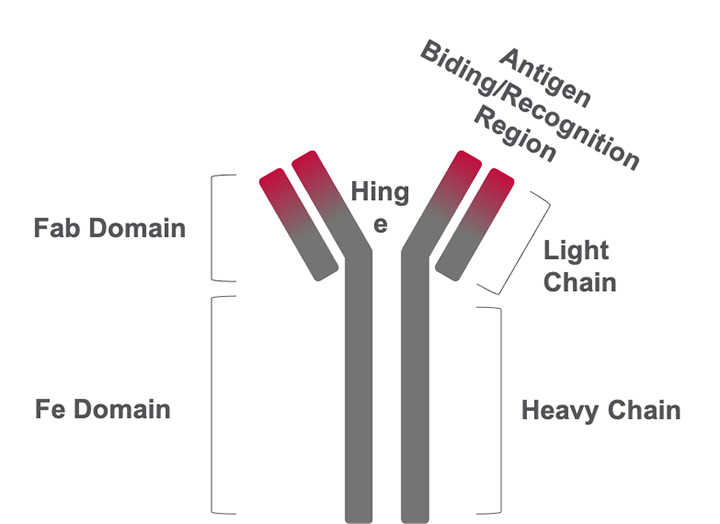

End-users likely do not have a deep understanding of how the filtration industry is supporting their health. Vaccines are a hot topic right now. Every vaccine developed and produced requires microfiltration. Microfiltration is the separation of particles 10um to 0.1um in size from a process liquid. While liquid filtration down to 1 micron has been standard for some time, the demands at smaller microns, in combination with strict regulatory expectations, are pushing filter media development to new levels.

The Milken Institute publicly tracks COVID-19 treatments and vaccines. As of today, 251 known vaccines are using microfiltration to ensure the world’s seven billion residents have access to life saving vaccinations. And as the vaccine market is growing, the advancements in filtration open up the possibility for innovation in therapeutics adding to the market space in which we play.

A call to action

So, what does all this mean for the filtration industry? How can filtration businesses meet the increasing demand for high-performance filtration, ensure end-users receive the protection they seek, and capture the value commensurate with the performance of filtration products?

Filtration organizations can develop tools and best practices – especially application-specific advice and guidance on key sustainability issues – that help ensure the industry captures the value its products provide. Proactively working with organizations such as LEED and WELL Building Standards, the industry can support the advancement of filtration best practices in public buildings around the world. The industry can work outside the filter media market to support the development and adoption of enabling technologies. The industry can also work to incorporate sensors and IAQ measurement systems that measure air quality, not just filter rating.

Well-developed and coherent technical standards allow effective benchmarking and data tracking. The filtration industry came together to put forward face covering standards during a time of uncertainty. Setting a minimum, consistent standard for safety provided technical guidance and ensured protection for end users. The industry was also able to help support best-in-class material availability for those in greatest need.

Not only has the filtration industry been able to contribute to making the market more robust, but is has also created trust and stability in a time of great need. Advertising the filtration industry’s accomplishments is an important part of the industry’s growth.

A bold industry-wide “advertisement” for high technical standards would be to move past the “one and done” testing often seen in the industry. Filters need to provide end-users with the level of safety they believe they are buying. If the filtration industry can establish a credible system that demonstrates filter efficacy, it can create a high level of trust with customers. Creating voluntary rigor to consistently meet minimum standards would be a big step forward. Creating a U.S. version of Eurovent – a voluntary pledge to meet standards verified by 3rd party periodic audits – would certainly help the filtration industry move toward a global best practice.

The filtration industry can continue these efforts by engaging with policy makers and key stakeholders to advance filtration public policy issues. Having set a common baseline of global minimum standards well understood by the public, the industry can turn to meeting the challenges of the future. Local governments, well-educated consumers and yet unknown crises will present ever-increasing challenges. With the experience of the COVID-19 pandemic, the industry has the ability to lean on a proven track record of success.

References

- “Air Pollution,” World Health Organization, https://www.who.int/health-topics/air-pollution#tab=tab_1

- Organization for Economic Cooperation and Development. (OCED), “The economic consequences of outdoor air pollution,” https://www.oecd.org/environment/indicators-modelling-outlooks/Policy-Highlights-Economic-consequences-of-outdoor-air-pollution-web.pdf

- “International Decade for Action ‘Water for Life’ 2005-2015,” United Nations Department of Economic and Social Affairs (UNDESA),” https://www.un.org/waterforlifedecade/human_right_to_water.shtml

- “Home Water Filtration Unite Market Size, Share & Trends Analysis,” Grand View Research, https://www.grandviewresearch.com/industry-analysis/home-water-filtration-unit-market